Spread Duration Vs Interest Rate Duration . These many factors are calculated. how does spread duration differ from other duration metrics like modified duration, effective duration, and macaulay. duration is a measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates. for risky bonds, duration is defined as sensitivity of price due to change in underlying yield while spread duration is. spread duration helps assess credit risk exposure, providing insights into how changes in credit spreads can impact bond prices. spread duration is the sensitivity of a security’s price to changes in its credit spread. duration is a measurement of a bond’s interest rate risk that considers a bond’s maturity, yield, coupon and call features. In general, the higher the duration,. Introduction to duration spread and interest rate risk.

from seekingalpha.com

how does spread duration differ from other duration metrics like modified duration, effective duration, and macaulay. These many factors are calculated. spread duration is the sensitivity of a security’s price to changes in its credit spread. Introduction to duration spread and interest rate risk. duration is a measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates. spread duration helps assess credit risk exposure, providing insights into how changes in credit spreads can impact bond prices. for risky bonds, duration is defined as sensitivity of price due to change in underlying yield while spread duration is. duration is a measurement of a bond’s interest rate risk that considers a bond’s maturity, yield, coupon and call features. In general, the higher the duration,.

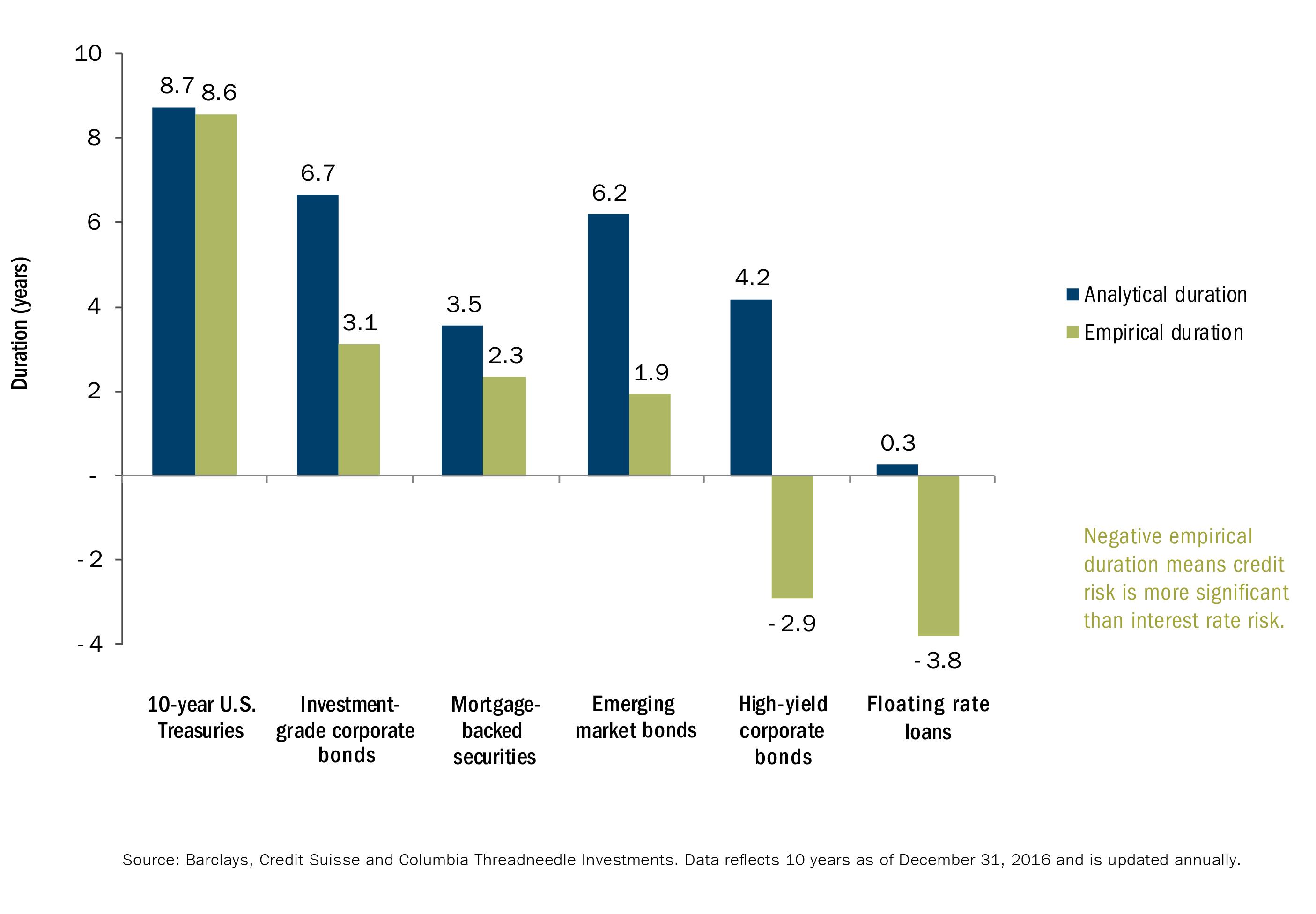

Empirical Duration A Better Way To Compare Interest Rate Sensitivity

Spread Duration Vs Interest Rate Duration spread duration is the sensitivity of a security’s price to changes in its credit spread. for risky bonds, duration is defined as sensitivity of price due to change in underlying yield while spread duration is. These many factors are calculated. In general, the higher the duration,. spread duration helps assess credit risk exposure, providing insights into how changes in credit spreads can impact bond prices. duration is a measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates. duration is a measurement of a bond’s interest rate risk that considers a bond’s maturity, yield, coupon and call features. spread duration is the sensitivity of a security’s price to changes in its credit spread. how does spread duration differ from other duration metrics like modified duration, effective duration, and macaulay. Introduction to duration spread and interest rate risk.

From analystprep.com

Interest Rates AnalystPrep FRM Part 1 Study Notes Spread Duration Vs Interest Rate Duration how does spread duration differ from other duration metrics like modified duration, effective duration, and macaulay. spread duration helps assess credit risk exposure, providing insights into how changes in credit spreads can impact bond prices. duration is a measurement of a bond’s interest rate risk that considers a bond’s maturity, yield, coupon and call features. spread. Spread Duration Vs Interest Rate Duration.

From www.slideserve.com

PPT Chapter 13 PowerPoint Presentation, free download ID6802356 Spread Duration Vs Interest Rate Duration for risky bonds, duration is defined as sensitivity of price due to change in underlying yield while spread duration is. duration is a measurement of a bond’s interest rate risk that considers a bond’s maturity, yield, coupon and call features. spread duration is the sensitivity of a security’s price to changes in its credit spread. Introduction to. Spread Duration Vs Interest Rate Duration.

From www.livewiremarkets.com

Investor lesson How interest rate duration can "insure" your portfolio Spread Duration Vs Interest Rate Duration for risky bonds, duration is defined as sensitivity of price due to change in underlying yield while spread duration is. These many factors are calculated. Introduction to duration spread and interest rate risk. spread duration is the sensitivity of a security’s price to changes in its credit spread. In general, the higher the duration,. how does spread. Spread Duration Vs Interest Rate Duration.

From analystprep.com

Interest Rate Futures AnalystPrep FRM Part 1 Study Notes Spread Duration Vs Interest Rate Duration how does spread duration differ from other duration metrics like modified duration, effective duration, and macaulay. duration is a measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates. In general, the higher the duration,. These many factors are calculated. for risky bonds, duration is defined as. Spread Duration Vs Interest Rate Duration.

From www.livewiremarkets.com

Investor lesson How interest rate duration can "insure" your portfolio Spread Duration Vs Interest Rate Duration duration is a measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates. spread duration is the sensitivity of a security’s price to changes in its credit spread. spread duration helps assess credit risk exposure, providing insights into how changes in credit spreads can impact bond prices.. Spread Duration Vs Interest Rate Duration.

From www.youtube.com

CFA Level 1 Fixed Reading 55 Understanding Fixed Risk Spread Duration Vs Interest Rate Duration Introduction to duration spread and interest rate risk. spread duration is the sensitivity of a security’s price to changes in its credit spread. duration is a measurement of a bond’s interest rate risk that considers a bond’s maturity, yield, coupon and call features. In general, the higher the duration,. spread duration helps assess credit risk exposure, providing. Spread Duration Vs Interest Rate Duration.

From analystprep.com

Interest Rates AnalystPrep FRM Part 1 Study Notes Spread Duration Vs Interest Rate Duration for risky bonds, duration is defined as sensitivity of price due to change in underlying yield while spread duration is. how does spread duration differ from other duration metrics like modified duration, effective duration, and macaulay. Introduction to duration spread and interest rate risk. In general, the higher the duration,. These many factors are calculated. spread duration. Spread Duration Vs Interest Rate Duration.

From www.financestrategists.com

Spread Duration Definition, Components, & Applications Spread Duration Vs Interest Rate Duration spread duration is the sensitivity of a security’s price to changes in its credit spread. for risky bonds, duration is defined as sensitivity of price due to change in underlying yield while spread duration is. These many factors are calculated. In general, the higher the duration,. spread duration helps assess credit risk exposure, providing insights into how. Spread Duration Vs Interest Rate Duration.

From www.financestrategists.com

Spread Duration Definition, Components, & Applications Spread Duration Vs Interest Rate Duration for risky bonds, duration is defined as sensitivity of price due to change in underlying yield while spread duration is. spread duration is the sensitivity of a security’s price to changes in its credit spread. Introduction to duration spread and interest rate risk. spread duration helps assess credit risk exposure, providing insights into how changes in credit. Spread Duration Vs Interest Rate Duration.

From www.financestrategists.com

Duration vs Maturity Similarities, Differences, & When to Use Spread Duration Vs Interest Rate Duration spread duration helps assess credit risk exposure, providing insights into how changes in credit spreads can impact bond prices. how does spread duration differ from other duration metrics like modified duration, effective duration, and macaulay. Introduction to duration spread and interest rate risk. These many factors are calculated. In general, the higher the duration,. for risky bonds,. Spread Duration Vs Interest Rate Duration.

From financialdesignstudio.com

Managing Interest Rate Risk in your Bond Investments Spread Duration Vs Interest Rate Duration spread duration helps assess credit risk exposure, providing insights into how changes in credit spreads can impact bond prices. duration is a measurement of a bond’s interest rate risk that considers a bond’s maturity, yield, coupon and call features. duration is a measure of the sensitivity of the price of a bond or other debt instrument to. Spread Duration Vs Interest Rate Duration.

From www.slideserve.com

PPT Chapter 7 (Conti.)98.10.16 PowerPoint Presentation, free download Spread Duration Vs Interest Rate Duration spread duration is the sensitivity of a security’s price to changes in its credit spread. spread duration helps assess credit risk exposure, providing insights into how changes in credit spreads can impact bond prices. These many factors are calculated. duration is a measurement of a bond’s interest rate risk that considers a bond’s maturity, yield, coupon and. Spread Duration Vs Interest Rate Duration.

From www.investopedia.com

Understanding Treasury Yield and Interest Rates Spread Duration Vs Interest Rate Duration for risky bonds, duration is defined as sensitivity of price due to change in underlying yield while spread duration is. how does spread duration differ from other duration metrics like modified duration, effective duration, and macaulay. duration is a measurement of a bond’s interest rate risk that considers a bond’s maturity, yield, coupon and call features. These. Spread Duration Vs Interest Rate Duration.

From www.researchgate.net

DurationMaturity Relationship Download Scientific Diagram Spread Duration Vs Interest Rate Duration spread duration is the sensitivity of a security’s price to changes in its credit spread. duration is a measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates. These many factors are calculated. for risky bonds, duration is defined as sensitivity of price due to change in. Spread Duration Vs Interest Rate Duration.

From seekingalpha.com

Empirical Duration A Better Way To Compare Interest Rate Sensitivity Spread Duration Vs Interest Rate Duration for risky bonds, duration is defined as sensitivity of price due to change in underlying yield while spread duration is. spread duration is the sensitivity of a security’s price to changes in its credit spread. duration is a measurement of a bond’s interest rate risk that considers a bond’s maturity, yield, coupon and call features. duration. Spread Duration Vs Interest Rate Duration.

From www.slideserve.com

PPT Chapter 5 Hedging InterestRate Risk with Duration PowerPoint Spread Duration Vs Interest Rate Duration In general, the higher the duration,. how does spread duration differ from other duration metrics like modified duration, effective duration, and macaulay. spread duration helps assess credit risk exposure, providing insights into how changes in credit spreads can impact bond prices. These many factors are calculated. Introduction to duration spread and interest rate risk. spread duration is. Spread Duration Vs Interest Rate Duration.

From analystprep.com

OneFactor Risk Metrics and Hedges AnalystPrep FRM Part 1 Study Notes Spread Duration Vs Interest Rate Duration spread duration helps assess credit risk exposure, providing insights into how changes in credit spreads can impact bond prices. Introduction to duration spread and interest rate risk. how does spread duration differ from other duration metrics like modified duration, effective duration, and macaulay. for risky bonds, duration is defined as sensitivity of price due to change in. Spread Duration Vs Interest Rate Duration.

From www.financestrategists.com

Spread Duration Definition, Components, & Applications Spread Duration Vs Interest Rate Duration Introduction to duration spread and interest rate risk. how does spread duration differ from other duration metrics like modified duration, effective duration, and macaulay. These many factors are calculated. spread duration is the sensitivity of a security’s price to changes in its credit spread. duration is a measure of the sensitivity of the price of a bond. Spread Duration Vs Interest Rate Duration.